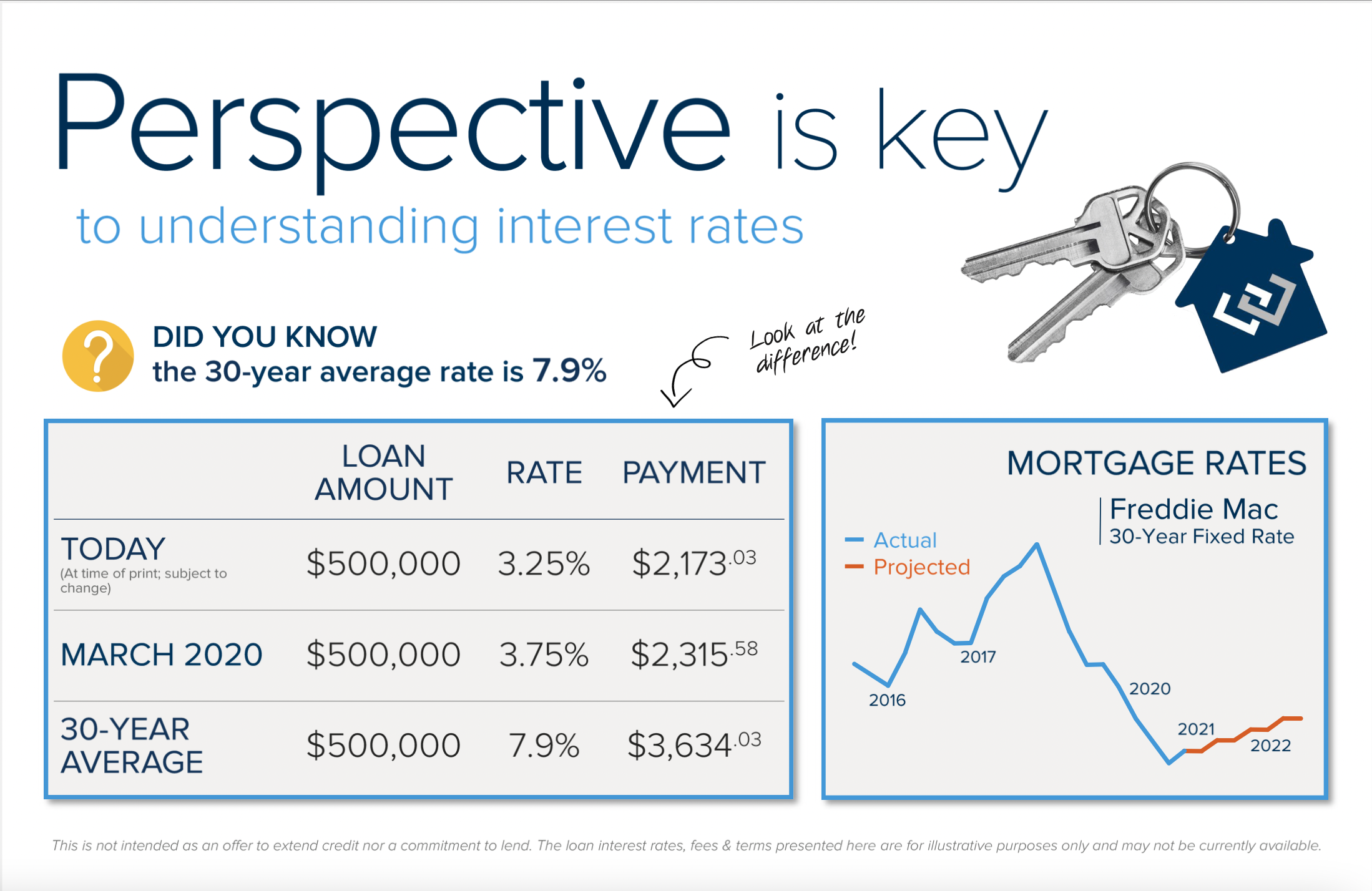

Interest rates are historically low and are predicted to increase over the next year. Rates are one-half of a point lower since March of 2020 and over a point lower since 2019. Keep in mind that today’s rate is well below the 30- year average of 7.9%. These rates will go down in history and the folks that utilize them via purchase or refinance will be grateful they did.

Did you know that for every one-point rate increase, a buyer loses 10% in buying power? For example: a buyer approved for $500,000 would need to adjust their price to $450,000 (10% lower) in order to keep the same monthly payment. The low rates have helped to offset the price appreciation we have seen in our area, and have been a key factor in helping with affordability.

I have a list of preferred lenders that are responsive, reputable, and competitive. If you’d like a referral or have any questions about how today’s interest rate may affect your bottom line please contact me. It is my goal to help keep my clients informed and empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link