Markets change fast! We experienced a substantial shift in 2022 with the first half of the year feeling like a completely different market than the second half of the year. A 3-point increase in interest rate was the main culprit along with inflation and affordability for the 2022 market correction we experienced. A market correction is defined by prices reverting by 10% or more. In January 2022, the median price in Whatcom County started at $550,000 then peaked at $659,000 in June, and ended the year at $590,000 (-10%). In Skagit County, the median price started at $533,000 then peaked at $595,000 in April, and ended the year at $525,000 (-12%). Keep in mind that the December 2022 median price was also up 17% over the January 2021 median price in Whatcom County and up 18% in Skagit County. This illustrates that the correction was only off the peak of spring 2022 not off of the strong equity that was built prior to that intense run-up.

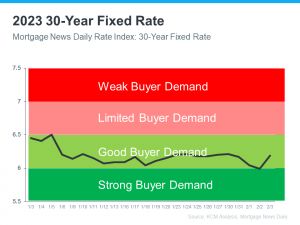

As we find ourselves in mid-Q1 2023 all data points and anecdotal stories are pointing to most of the market correction being behind us and yet again, another shift. Interest rates peaked in November 2022 at just over 7% and have since come down. Experts are predicting rates to find themselves under 6% as we travel through the easing of inflation in 2023. Some neighborhoods may have a little bit more to go, but others are already showing some growth. Each neighborhood is unique and should be analyzed month by month, but at some point in the first half of the year, we will find stability across the board.

As we find ourselves in mid-Q1 2023 all data points and anecdotal stories are pointing to most of the market correction being behind us and yet again, another shift. Interest rates peaked in November 2022 at just over 7% and have since come down. Experts are predicting rates to find themselves under 6% as we travel through the easing of inflation in 2023. Some neighborhoods may have a little bit more to go, but others are already showing some growth. Each neighborhood is unique and should be analyzed month by month, but at some point in the first half of the year, we will find stability across the board.

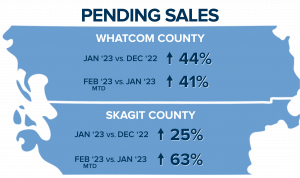

The well-defined price correction and interest rates lowering have brought many buyers back to the market. In fact, pending sales in Whatcom County in January 2023 were up 44% over December 2022. Even more so an indicator: pending sales are up 41% month-to-date (MTD) in February over January 2023! In Skagit County, pending sales in January 2023 were up 25% over December 2022, and up 63% MTD over January 2023.

The well-defined price correction and interest rates lowering have brought many buyers back to the market. In fact, pending sales in Whatcom County in January 2023 were up 44% over December 2022. Even more so an indicator: pending sales are up 41% month-to-date (MTD) in February over January 2023! In Skagit County, pending sales in January 2023 were up 25% over December 2022, and up 63% MTD over January 2023.

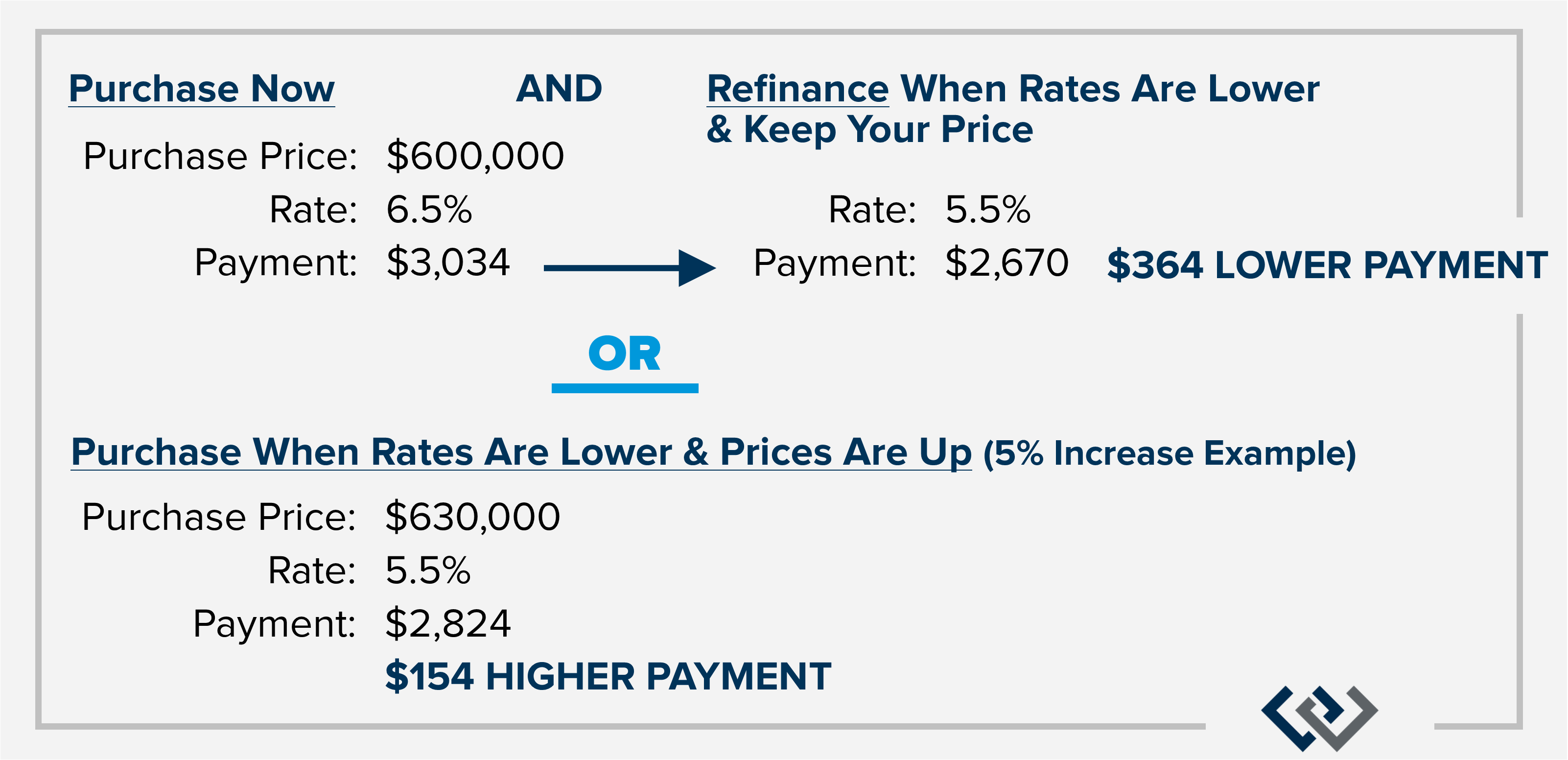

This pent-up demand has come at a time when listing inventory is seasonally scarce and has started to point to an upcoming seller’s market in many areas. Months of inventory is how we define market conditions. 0-2 months is a seller’s market, 2-4 months a balanced market, and 4 months plus a buyer’s market. In Whatcom County, we ended 2022 with 4.4 months of inventory based on pending sales, and in January 2023 had 2.4 months, and MTD is sitting at 2.2 months. In Skagit County, we ended 2022 with 3.2 months of inventory based on pending sales, and in January 2023 had 2 months, and MTD is sitting at 1.3 months.After months of price reductions and searching for the bottom, we are now starting to come across some multiple offers and price increases. This is leaving clues that the bottom was reached and that we are now stabilizing and looking toward the predicted growth that 2023 has to offer. Buyers are eager for additional selection and will welcome the spring influx of new listings. If sellers are ready, they should not hesitate. Should rates lower as the new listings arrive, sellers will be well supported by a willing buyer audience ready to absorb any growth in inventory.Buyers need to understand that rates and prices are closely related and that waiting for rates to hit a certain point may be detrimental to securing a stabilized price. Many buyers are heading into today’s market with a refinance in mind down the road. They are aware that prices will rise as rates lower, so they are looking to obtain a lower price now with a higher rate and once the rate hits their desired level, they will refinance to lower their payment all while holding on to their lower basis point.For example, if a buyer bought now at $600,000 with 20% down and a rate of 6.5% their monthly principal and interest payment would be $3,034. If a year from now, rates are at 5.5% and prices are up 5% and that same buyer refinances, they will save $292 a month on their payment and $30,000 in principal. This would also be $154 lower than what the payment would be at the appreciated price with the lower rate!

|

|

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link