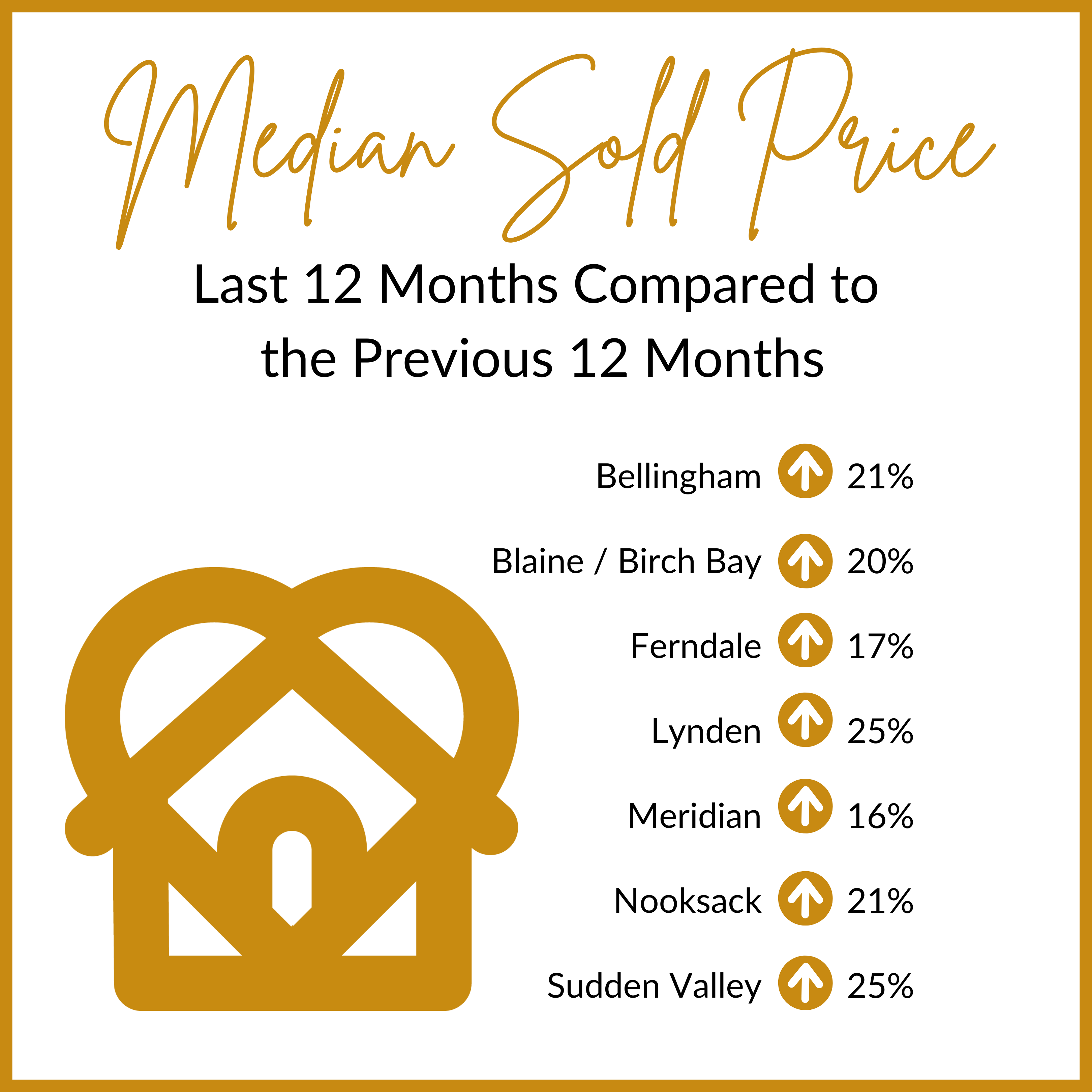

Did you know that over 50% of homeowners in Washington State have over 50% home equity? We have had 10 years of price appreciation, and the last 3 years have been record-breaking. The chart below shows complete year-over-year (the last 12 months over the previous 12 months) price appreciation for the seven main market areas in Whatcom County. Home equity gains have been plentiful!

What does this mean when you go to sell? You need to consider capital gains taxes when estimating your total profit. This is important as we typically move our profit into our next home, making this a critical element in planning our future. You can qualify for a tax exclusion: $250,000 for a single person and $500,000 for a couple as long as you meet certain requirements.

- You must have owned the house for at least two years. Check out this IRS linkfor more details.

- And you must have lived in the house as your primary residence for two out of the last five years, ending on the date of the sale.

The two years do not need to be consecutive as long as you’ve lived in your home for a total of 24 months out of the five years prior to the sale. You can also only claim the exclusion every two years. This is important for folks who own multiple homes and are looking to liquidate. This would need to be strategically spaced and would require living in each home for the designated amount of time.

Another important element for calculating the tax implication is understanding your cost basis. The cost basis is a combination of the purchase price, certain legal fees, improvement costs, and more. It is important to have good record-keeping on all capital improvements you’ve made to your home to increase your cost basis which will in turn decrease your taxable profit. Capital improvements increase the value of your property versus a repair which only restores the property to its original condition. This informative Charles Schwab article provides a sample tax bill that outlines how capital improvement can help offset your tax burden.

Of course, consulting your trusted CPA on your tax implications is a valuable resource. It is my hope that this overview of the requirements and how you would go about a calculation helps you understand how to prepare for your next move if you are in an equity position that would incur capital gains. It is always my goal to help keep my clients informed and empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link