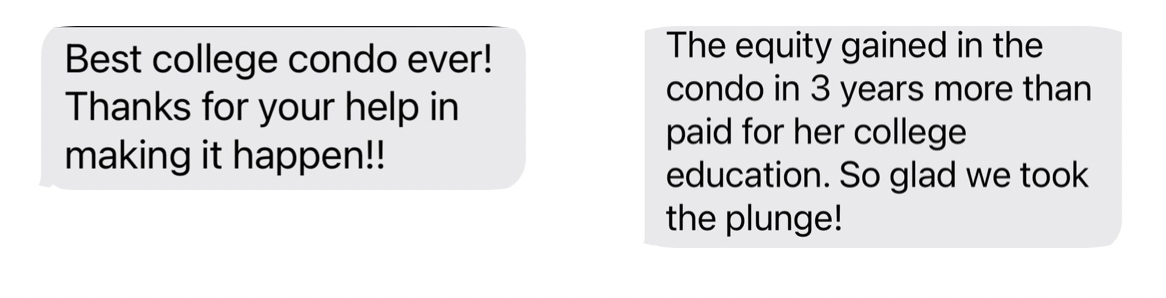

3 Years ago a family I had met in my previous career reached out to me because their daughter was coming to Western Washington University. They had the idea that on-campus housing or even renting an apartment off-campus would be a waste of money. And they were SO RIGHT! Sadie (pictured above) just graduated from WWU and you can see the messages above about how beneficial her parent’s investment was for their finances! I’m proud to say this story is just one of MANY families that I’ve helped strategize how to fund education for their children or grandchildren.

I want this for all of YOU too! There are 3 ways you can invest in Real Estate to pay for or offset the cost of Higher Education for your children. Please read about them below and if any or all of them spark an interest for your family, please reach out and let’s start planning and dreaming!

INVEST NOW:

Why not buy an investment property now with the mindset that the equity it will gain by the time your child goes to college will be enough to cover the education cost. This means you buy a home, and have the tenants pay the mortgage for you while you also get to bet on the value of the home increasing. When it is time to go to school, you sell the property to fund their education!

INVEST LATER FOR INCOME:

Start planning now so that you are in a financial position when your child goes to college to buy a home (or condo) in the city they will go to school in. You’ll need to ideally have 25% of the purchase price set aside to use as a down payment (to secure the best loan program). Ideally, your student finds roommates and the rent you can charge pays for the whole mortgage and your child lives for free. AND you’ll have the added benefit of the next hack as well.

INVEST LATER FOR EQUITY

Sometimes it doesn’t make sense to have room mates like the above scenario or even if you do you can’t totally cover the cost of the mortgage with the rents you are collecting. Like Sadie’s family the equity you’ll have gained in the years your kid is going to college will reimburse you for their college education. When they no longer need to live in the house, you sell it and recover the investment you made in their education.

Does it seem overwhelming to become a landlord or maintain another home? I have tried and true processes for both of these hurdles. I’m happy to teach you how to manage the property for less than an hour a month of your time, and it will be totally worth the payoff!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link